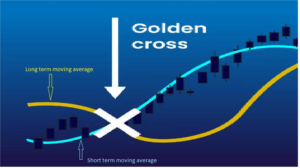

The Golden Cross strategy is widely used in technical analysis to get an idea about current trends in the index or stock. The golden crossover is an indicator which can be used to decide the bullishness of a stock or index. This indicator makes use of short term and long term moving averages. When a short-term moving average crosses above a long-term moving average, it signals a shift in stock or index sentiment from bearish to bullish.

The most common moving averages used in a Golden Cross are:

- 50-day moving average (short-term)

- 200-day moving average (long-term)

Phases of the Golden Cross:

Downtrend Ending: During this phase the price remains downtrend, and the short-term moving average is below the long-term moving average. The gap between the short and long moving average is getting reduced in this phase.

Crossover : In this phase, the short term moving average crosses above the long term moving average. This signifies a shift in the momentum, and it starts moving upward.

Uptrend Begins: After the crossover phase, the price often enters an upward trend as bullish sentiment strengthens.

Interpretation:

Bullish signal: Traders view the Golden Cross as a buy signal and can expect further rise in the price. Confirmation: Along with the golden cross over, it is also recommended to check the rise in the volume, which indicates strong market participation by big institutions.

We must make note that the golden crossover does not always guarantee a rise in the price. One should also consider some other indicators to support bullishness. Some of the widely used indicators are listed below.

1 Relative Strength Index (RSI)

2 Moving Average Convergence Divergence (MACD)

3 On-Balance Volume (OBV)

4 Stochastic Oscillator

5 Bollinger Bands

Note: You can also read about the opposite of the golden cross strategy, i.e., the death cross strategy.

Limitation of Golden Cross strategy:

1 Lagging Indicator : The golden cross is based on historical moving average data so by the time it has formed golden cross some portion of the upward movement may already have occurred hence it reduce the overall potential of profit

2 False Signals : During the volatile or sideways markets siltation, Golden Cross strategy may result in whipsaws—frequent false signals that cause traders to buy at the wrong price which eventually leads to losses.

3 Ignorance of Market Fundamentals : The Golden Cross strategy is purely a technical signal and ignores all the important macroeconomic conditions, company related news/data, or broader market trends that may affect price fluctuation.

Conclusion:

The Golden crossover strategy can be use by trader to confirm the bullish trend along side with some other widely used indicator.