The Stochastic Oscillator is a momentum indicator which is used in technical analysis that compares a specific closing price of an stock or index to a range of its prices over a certain period. It helps traders identify overbought and oversold zone, potential trend reversals, and possible bullish or bearish signal.

Key Components of the Stochastic Oscillator:

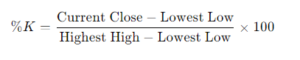

- %K Line (Fast Stochastic): The main line that represents the current market price of the asset compared to its high-low range over a specific number of periods (mostly 14). It is calculated as per below image:

Where:

- Current Close is the most recent closing price.

- Lowest Low is the lowest price over the specified number of periods.

- Highest High is the highest price over the specified number of periods.

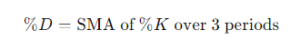

- %D Line (Slow Stochastic): The %D line is a moving average (typically a 3-period SMA) of the %K line, providing a smoother line for better signal confirmation. It is often used to generate trading signals.

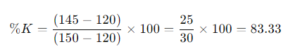

Example Calculation:

Assume we have the following data for a 14-day period:

- Highest High = 150

- Lowest Low = 120

- Current Close = 145

The %K line would be calculated as follows:

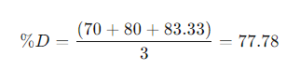

If we then calculate the %D line (SMA of %K over 3 days), assume the %K values over the last 3 periods are 70, 80, and 83.33:

Trading Strategies Using Stochastic Oscillator:

- Overbought/Oversold Strategy:

-

- Buy when the %K or %D lines fall below 20 (indicating oversold conditions) and cross back above it.

- Sell when the %K or %D lines rise above 80 (indicating overbought conditions) and cross below it.

- Crossover Strategy:

- Buy when the %K line crosses above the %D line in oversold territory.

- Sell when the %K line crosses below the %D line in overbought territory.

One should also consider some other indicators to support a downtrend or uptrend, some of the widely used such indicators are listed below.

1 Golder cross OR Death cross

2 Moving Average Convergence Divergence (MACD)

3 On-Balance Volume (OBV)

4 Bollinger Bands

Feel free to share your thoughts on Stochastic Oscillator or ask any questions in the comments below. Your feedback helps us improve, and we’re here to clarify any points you may have!